1. What Is Your Opportunity Cost If You Work The Cash Register?

Formula to Summate Opportunity Cost

Opportunity Cost is the cost of the adjacent best alternative, forgiven. When a business must decide among alternate options, they will cull the one that provides them the greatest return. Frankly speaking, there is no such specifically agreed or defined on a mathematical formula for the adding of opportunity price, but there are certain ways to think well-nigh those opportunity costs in a mathematical manner, and the below formula is 1 of them.

Even so, this value may or may not always be measured in terms of coin. Value can also be measured by other techniques, for case, satisfaction or time.

Opportunity Toll = Render of Next All-time Alternative non chosen – Return of the selection called

Y'all are gratuitous to use this image on your website, templates etc, Delight provide us with an attribution link Commodity Link to exist Hyperlinked

For eg:

Source: Opportunity Cost Formula (wallstreetmojo.com)

Ane relative formula for the adding of opportunity cost could exist –

If we think about the cost of opportunity like this, then the equation is very like shooting fish in a barrel to sympathize, and it's straightforward.

Examples

You lot can download this Opportunity Toll Formula Excel template here – Opportunity Cost Formula Excel template

Case #ane – Reliance JIO

Reliance Jio Infocomm Ltd (known as Jio), a mobile network operator in India that is owned by Reliance Industries, which is headquartered in Mumbai.

The service that was launched for all users on 5th September 2016 with a 'Welcome Offer,' was originally introduced in beta version for the employees of Reliance only on Dec 27, 2015, to marking the 80-third birth ceremony of Dhirubhai Ambani, who was the founder of Reliance Industries.

The introductory offering lured many Indian customers, and it was able to manage to get 72 million prime customers within the first 3 months of its launch, simply afterward, the visitor decided to extend its freebies for another iii months when it had another choice of actually charging the customer and earn acquirement and hence it chose to forgive it's some other best alternate for not choosing to pecker their customers for the services.

Reliance Jio Infocomm really missed out on an $800 million (which is Rs 5,400 crore) revenue opportunity as mentioned above by offering an additional three months freebies, i.e., free services to its 72 million Prime number customers who were actually ready to pay them from 1st of April.

Instance #ii – Paytm Investment Opp

Paytm is an Indian e-commerce digital wallet and payment organisation company, based out of NOIDA S.E.Z in India. Paytm is available ten Indian languages, and information technology offers online use-cases like utility nib payments, travel, movies, mobile recharges, and events bookings every bit well as in-shop payments at the grocery stores, vegetables and fruits shops, restaurants, pharmacies, parking, tolls, and education institutions with the QR code of Paytm Paytm, which is presently also loss-making company and which has however to prove its mettle when it comes to the business model and providing the long-term sustainable product.

Berkshire a globally renowned firm that has a marketplace capitalization Market capitalization is the market value of a company's outstanding shares. It is computed as the product of the total number of outstanding shares and the price of each share. read more of around $500 Billion. Based on its past record, it is too known for i of the most astute and sharpest investors in the earth. Berkshire decided to selection upwardly a 3 to 4% stake in payments major with Rs 2,500 crore (around $356 million) that was fabricated.

The question at present arises every bit to why and what led Berkshire to invest in Paytm, whose losses stood at Rs 900 crore, whereas information technology's coming to its acquirement it was around Rs 829 crore, and in the year prior, its loss effigy had touched Rs 1,497 crore? What is its expectation with that investment?

Berkshire was aware of the financial opportunity which was available in the Indian market that information technology had to offering. It would not like to miss it. And so here, the opportunity cost for Berkshire volition be Rs 2500 crore equally easily it could have called whatever other listed company with a turn a profit-making visitor.

Opportunity Cost Calculator

You tin use the following Opportunity Cost Estimator.

| Render of Next Best Culling Not Chosen | |

| The Return of the Option Chosen | |

| Opportunity Cost Formula | |

| Opportunity Cost Formula = | Return of Next Best Alternative Not Chosen – The Return of the Choice Called |

| 0 – 0 = | 0 |

Interpretation

- Opportunity cost is the value of something when a sure course of activeness is chosen. The do good or value that was given upwardly can refer to decisions in your personal life, in an organization, in the country or the economy, or in the environment, or on the governmental level.

- These kinds of decisions will typically involve constraints like time, social norms, resources, rules, and physical realities.

- An investor goes completely to cash when he decides that the market is overvalued. This volition dramatically reduce their risk at the cost of opportunity of the potential returns that are being invested.

- Another case where student considers the cost of 4-year university education by calculating total hostel, tuition, and other expenses Other expenses comprise all the non-operating costs incurred for the supporting business operations. Such payments similar rent, insurance and taxes take no direct connection with the mainstream business activities. read more than for the period. They could also include the cost of the opportunity of missing four-years of bacon in their calculations.

- A headphone manufacturer facing healthy contest from low-cost products with like designs of their ain. They tin decide to increase the quality of their build (for e.g., Apple) to brand the competition await and experience comparatively cheap. The opportunity cost of the new design of the product will be the increased cost and its inability to compete on price.

- Opportunity costs are truly everywhere, and they occur with every conclusion we make, whether it's big or minor.

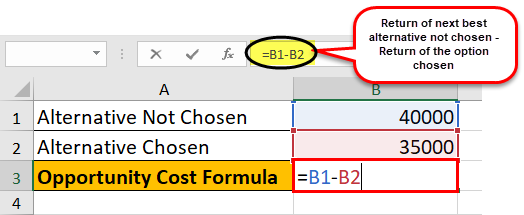

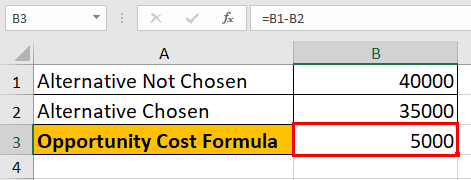

Opportunity Cost Calculation in Excel

Let the states at present do the aforementioned Opportunity Cost example Opportunity Price is the do good that an individual is losing out past choosing i option instead of another selection. Let u.s. suppose that a person has $50000 in his hand and he has the selection to keep it with himself at home or deposit in the bank which will generate involvement of 4% annually then now the opportunity cost of keeping money at abode is $2000 per year. read more in Excel. This is very simple. You need to provide the 2 inputs of return of the adjacent best alternative not chosen and return of the option chosen. You can easily calculate the ratio in the template provided.

The opportunity price will be –

Opportunity Cost Video

Recommended Articles –

This has been a guide to Opportunity Cost Formula. Here we larn how to calculate opportunity cost using its formula along with some practical industry examples, a calculator, and a downloadable excel template. You lot tin acquire more well-nigh Excel Modeling from the post-obit articles –

- Cost Book Profit Analysis

- Cost vs Expense

- What is Implicit Cost?

- Price Accounting Online Course

1. What Is Your Opportunity Cost If You Work The Cash Register?,

Source: https://www.wallstreetmojo.com/opportunity-cost-formula/

Posted by: kerstendees1956.blogspot.com

0 Response to "1. What Is Your Opportunity Cost If You Work The Cash Register?"

Post a Comment